Fury as locals in secluded market town face 20-mile round trip to their nearest bank after Barclays announces closure of their local branch

Residents in a secluded market town have been left furious after the closure of their local Barclays means they now face a 20-mile round trip to the nearest branch.

Barclays in Middleton-in-Teesdale, County Durham, shut its doors for the final time on Friday, which means locals now face a hefty car journey to deal with a worker face-to-face.

The closure means that there will be no bespoke banking facilities left in the town, and just one cash point remains.

Locals will be forced to travel to Barnard Castle in County Durham to find their nearest Barclays, which is roughly a 20-minute drive and 30-minute bus journey.

The bank claims just 19 customers used the branch regularly, while 79 per cent of customers banked using the Barclays app, online or by phone in 2021.

Barclays in Middleton-in-Teesdale, County Durham, shut its doors for the final time on Friday

At McFarlane Family Butchers, Alastair McFarlane warned that cashless payments were costly for local businesses.

He said: ‘Everywhere is becoming more and more cashless and everybody seems to pay with their card nowadays.

‘It’s going to be a really big loss. Most people here are pensioners who don’t know how to use the online services.’

Barclays representatives will now be based out of Upper Teesdale Agricultural Support Services (UTASS) twice a week but no cash services will be available.

READ MORE: Last bank closes in Britain’s smallest city as Lloyds shuts its doors and final free cashpoint – leaving thousands facing a 15-mile trek to nearest branch

Emma Spry, an admin support worker at the charity, said the bank’s reduced opening hours had become restrictive to customers but its staff still provided invaluable support.

She said: ‘You try to phone them now and immediately you’re put on hold for 40 minutes to speak to somebody.

‘It’s almost like they don’t want customers.’

Ms Spry also claimed the loss of the town’s Post Office was still being felt, and she said losing the bank is now another barrier to get over.

She added: ‘We just feel forgotten here, it’s like we don’t matter.’

One resident, who did not give her name, said the bank would be a huge miss to the area.

She said: ‘It didn’t just serve Middleton in Teesdale, it served right up the dale. There used to be three banks here and now they’re all gone.’

A Barclays spokesperson said: ‘Our customers’ behaviour has changed significantly in recent years, with the majority now choosing online banking.

‘This is reflected at the Middleton-in-Teesdale branch, and as we adapt, we are finding new ways to support our customers by maintaining our community presence with options for customers who still require in-person support.

‘In Middleton-in-Teesdale we plan to open a Barclays Local – a cashless banking site where customers can meet a colleague face-to-face for banking support, as they would in a branch and without the need to travel. We are currently working with the local community to identify a suitable location and will announce details once confirmed.’

To use the module, simple enter your postcode, and your desired bank, and it will reveal the branches closed, or set to close, near you. Up to date as of 05/06/2023

The bank has already announced more than 70 closures this year , following in the footsteps of several other major companies including NatWest, Lloyds Banking Group and Halifax

The bank has already announced more than 70 closures this year, following in the footsteps of several other major companies including NatWest, Lloyds Banking Group and Halifax.

It comes as high street banks shift further to banking online and through apps.

The latest number of closures comes after the London-based banking firm announced it would be shutting at least 142 branches over the next two years.

Similarly, Lloyds announced it would be closing at least 84 banks by 2024, while NatWest said it had scheduled 14 closures.

Halifax will also close 47 branches while Santander will close five. Bank of Scotland said it will close 21 branches while RBS will shut four.

The closures have been deemed controversial by some who argue that many, particularly the elderly, still rely on in-person services and that closures will make it more difficult for those people to access financial services.

People should still be able to carry out basic banking tasks through local Post Offices – but this does not include opening new bank accounts, taking out loans or mortgages.

Most banks will also offer mobile banking services where a bank brings a bus to a local area and provides services that are usually available at a branch.

Campaigners have previously warned that the rapid branch closures across the UK is putting the elderly and vulnerable at risk – being left cut off from access to their money.

Earlier this year, Age UK’s charity director Caroline Abrahams said elderly customers risk being ‘cut adrift’ from banking services and banks should be doing ‘everything they can’ to ensure ‘essential’ services continue to be provided.

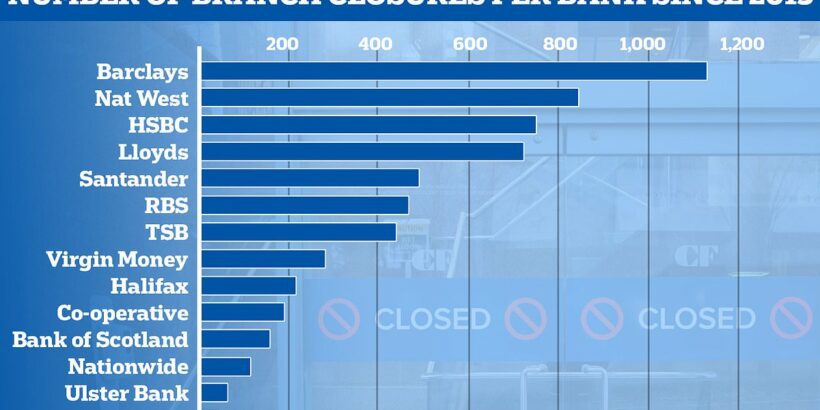

Barclays is the individual bank that has reduced its network the most, with 1,116 branches now closed since January 2015.

MailOnline has contacted Barclays for comment.

Source: Read Full Article